Welcome to Remote Deposit

HomePride Bank offers a convenient Remote Deposit service. This service allows you to deposit checks using your mobile device, providing flexibility and efficiency in managing your finances.

Key Benefits of Remote Deposit

- Convenience: Deposit checks at any time and from any location with internet access.

- Time-Saving: Eliminate the need to visit a bank branch or ATM to deposit checks.

- Efficiency: Quickly and securely manage your finances by depositing checks directly into your account.

- Accessibility: Available 24/7, allowing you to deposit checks at your convenience.

How Remote Deposit Enhances Your Banking Experience

- Streamlined Process: Simplifies the deposit process by reducing the need for physical visits.

- Increased Flexibility: Allows you to manage your finances on your schedule.

- Enhanced Security: Uses advanced encryption to protect your transactions and personal data.

Getting Started with Remote Deposit

To begin using Remote Deposit, ensure you have the following:

- HomePride Bank Account: A checking or savings account with HomePride Bank.

- Waiting Period: There is a 60-day waiting period after opening your account before you can use Remote Deposit, provided your account is in good standing.

- Account Status: Accounts must be in good standing. Access may be revoked for dormancy, write-offs, collections, or other adverse conditions.

- Online Banking Access: Enrollment in HomePride Bank's Online Banking service.

- Email: a verified email address on your mobile/online account. Go to your profile and add one if needed.

- Mobile App: Download the HomePride Bank Mobile App from the App Store or Google Play Store.

By leveraging Remote Deposit, you can enjoy a more flexible and efficient banking experience, making it easier to manage your financial activities from anywhere.

Deposit Limits

HomePride Bank has established the following limits for Remote Deposit:

Customers can request higher limits by completing a Mobile Deposit Limit Increase Request form. These requests are reviewed case-by-case by operations personnel.

How Remote Deposit Works

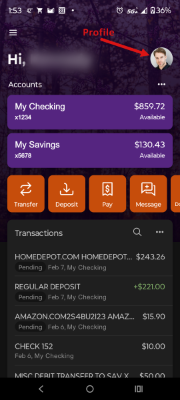

Note: remote deposit requires that you have an active email address associated with your online/mobile banking profile. To add an email, click update your profile information by clicking on your profile image.

Note: remote deposit requires that you have an active email address associated with your online/mobile banking profile. To add an email, click update your profile information by clicking on your profile image.

- Log In: Open the HomePride Bank Mobile App (for personal accounts) or the HomePride Commercial app (for business accounts) and log in with your Online Banking credentials.

- Navigate to Deposit: Select the account where you want to deposit the check.

- Enter Details: Input the check amount.

- Take Photos: Snap clear photos of the front and back of the check. Ensure the back is endorsed with your signature and "HomePride Mobile Deposit Only" printed on the second line.

- Review and Submit: Review the details and submit your deposit.

Tips for Successful Deposits

-

- Background: Use a clean, dark background for taking photos.

- Endorsement: Ensure the back of the check is properly endorsed.

- Matching Amounts: Verify that the check amount and entered amount match.

- Cut-off Time: Deposits must be submitted by 6 PM for same-day processing.

Security and Compliance

HomePride Bank adheres to strict security and compliance standards:

- Manual Review: Flagged deposits are manually reviewed by operations within 2 hours.

- Regulatory Compliance: Follows BSA, AML guidelines, and consumer protection laws like Regulation E.

- FFIEC Guidelines: Stays updated on FFIEC guidelines for RDC services.

Requesting Higher Deposit Limits

To request higher deposit limits, fill out the Remote Deposit Limit Increase Request form or download the form and bring it to your nearest branch location.

Customer Support

For assistance with Remote Deposit or any other banking service, contact HomePride Bank's customer service team at 855-447-2265 or visit your local branch. They can help with limit adjustment requests and provide guidance on using the service.

Remote Deposit FAQs

- A HomePride Bank checking or savings account.

- Enrollment in HomePride Bank's Online Banking.

- The HomePride Bank Mobile App.

- A verified email address associated with your account.

- A waiting period of 60 days after opening your account if it's new.